Traditional MMMs are breaking under modern marketing complexity

Marketing Mix Models (MMMs) have historically been used to estimate the impact of media, promotions, and other commercial levers on business outcomes like sales or profit. But while they remain popular in executive dashboards and budget planning, traditional MMMs are increasingly mismatched to the realities of today’s fragmented, dynamic, and digital heavy marketing environment. Their statistical backbone, often built on linear regression or stepwise variable selection, struggles with the scale, uncertainty, and heterogeneity of modern marketing data.

Traditional models typically rely on a fixed functional form, are sensitive to outliers, and assume stationarity over time. This means they work best in static environments where relationships between media spend and sales remain predictable. But media landscapes evolve rapidly, new platforms emerge, consumer behavior shifts, and external shocks like inflation, supply chain disruptions, or policy changes can dramatically alter response curves. When these changes occur, traditional models are slow to adapt and offer limited insight into uncertainty.

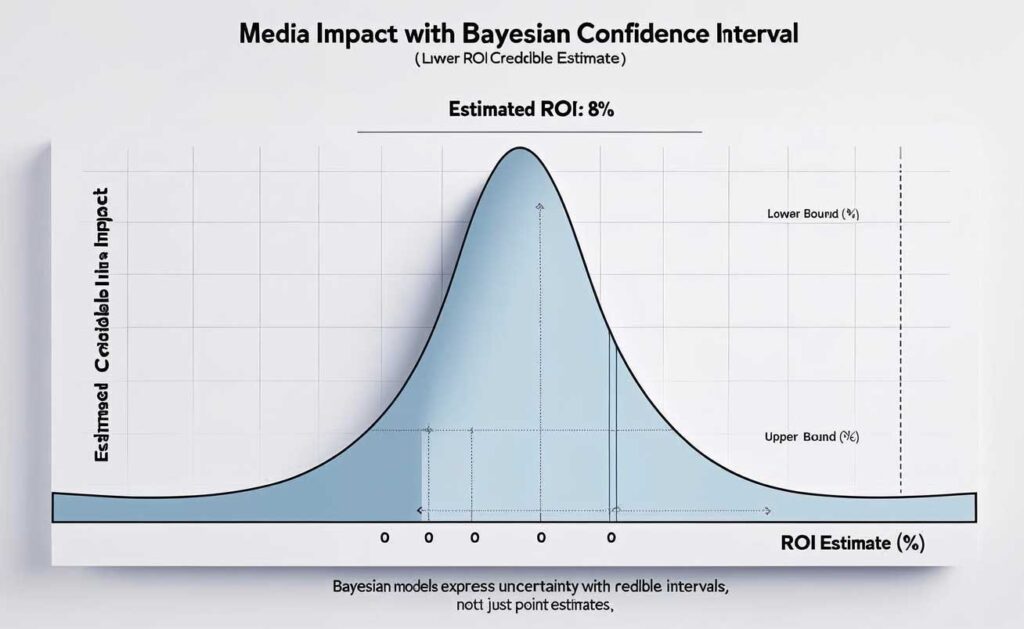

Moreover, traditional MMMs often produce point estimates without expressing confidence intervals, presenting marketing impact as a single truth. This can give decision-makers a false sense of certainty. In reality, media performance fluctuates across markets, channels, and time. Without a way to quantify variability or uncertainty, planning based on traditional MMM outputs becomes high-risk, especially for long-range forecasting or scenario simulation.

This is where Bayesian MMMX models emerge as a necessary evolution. They introduce a flexible, probabilistic framework that estimates impact, quantifies uncertainty, learns over time, and allows the model structure to reflect market dynamics. As marketing becomes more volatile and digitally complex, Bayesian MMMX represents the adaptive modeling architecture required to stay decision-relevant.

Bayesian modeling embraces uncertainty and that builds confidence

A key advantage of Bayesian MMMX is its ability to capture uncertainty transparently. Instead of returning single-point coefficients, Bayesian models return full posterior distributions for each variable. This means a marketer doesn’t just know that TV contributed “8.3%” to sales, they know that the model is 90% confident that TV’s contribution lies between 6.1% and 10.4%. These ranges become critical for executives planning media budgets in environments where ROI volatility is the norm.

Unlike classical models that mask their doubt, Bayesian MMMX explicitly shows it, and this is a strength, not a weakness. By visualizing credible intervals, marketing teams can better understand which levers are reliable bets and which are speculative. This promotes smarter risk management: more confident investment where the model agrees with historical trends, and cautious testing where uncertainty is wide.

This probabilistic approach also allows for scenario simulation, a feature underutilized in traditional MMMs. Bayesian models can simulate thousands of market futures by sampling from the posterior distributions of their parameters. This enables planning teams to ask: “What’s the expected impact if we shift 10% of the budget to YouTube, and what’s the worst-case range?” These simulations can be mapped across time, geography, and product lines to build robust investment scenarios grounded in statistical confidence.

The psychological impact of Bayesian framing is also notable. When stakeholders see a point estimate, they argue over precision. When they see a range, they discuss trade-offs. Bayesian outputs shift internal conversations from data skepticism to decision alignment, an underrated but vital benefit for crossfunctional teams navigating high-stakes marketing budgets.

MMMX expands capability beyond regression into learning systems

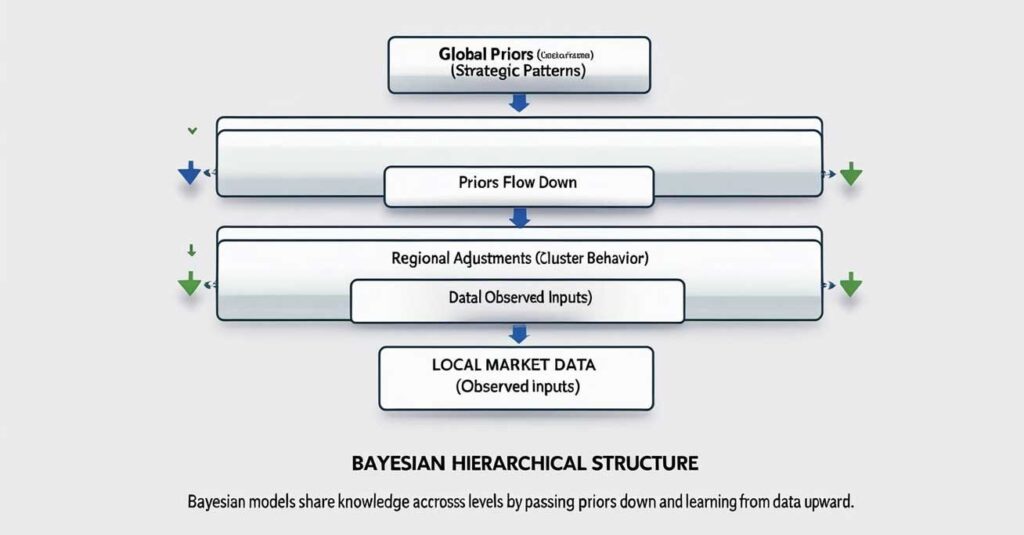

The “X” in MMMX refers to extended capabilities, from machine learning integrations and hierarchical modeling to scenario layers and geo-based customization. These models go beyond just running Bayesian regression. They often include modular components that allow integration of different priors, automated variable selection, outlier detection, and the ability to model nested structures, like regions within countries, or campaigns within brands.

This is especially important for global or multi-brand organizations, where traditional MMMs either become overly generalized (failing to capture local dynamics) or unscalable due to separate models per unit. Bayesian MMMX allows for hierarchical priors, where group-level patterns inform local estimates, dramatically improving accuracy while preserving scalability. For example, if an APAC market has a limited media history, the model can borrow strength from similar markets without hard-coding their behaviors.

Bayesian MMMX also opens the door to semi-automated updating. Because the model learns through iterative inference (e.g., MCMC or variational Bayes), it can update coefficients as new data is introduced, without needing to fully retrain from scratch. This means models can be refreshed monthly or even weekly, enabling a more agile planning cadence.

Furthermore, the flexibility of MMMX allows it to integrate non-media variables like inflation, seasonality, or external demand shocks as latent variables or priors, making it suitable for joint modeling of marketing and operational factors. In practice, this helps organizations not only measure spend efficiency but also simulate business outcomes under dynamic market conditions.

From analytics to advantage: the strategic payoff of Bayesian MMMX

While Bayesian MMMX offers technical sophistication, its true value lies in its strategic utility. In a world where marketing conditions shift rapidly, new channels, algorithm changes, policy regulations, decision-makers don’t just need precision. They need models that adapt, expose uncertainty, and simulate alternative futures. Bayesian MMMX delivers on all three.

For CFOs and CMOs under pressure to justify marketing spend, Bayesian outputs enable a more nuanced conversation. Instead of ROI as a static number, it becomes a probability-weighted projection. Instead of asking “what worked,” teams can ask “what’s likely to work next?” That shift turns MMMX into a forward looking planning system, not just a backward-looking attribution engine.

Bayesian MMMX is also inherently more collaborative and transparent. Because it externalizes uncertainty and logic, it invites discussion across data science, marketing, finance, and operations. This fosters organizational buy-in, a critical advantage when media strategy changes require cross-functional approval.

The final strategic benefit is simulation at scale. With Bayesian MMMX, organizations can model hundreds of budget allocation scenarios, run sensitivity tests, and stress test assumptions, all while factoring in uncertainty and macroeconomic volatility. This elevates the role of analytics from a report card to a decision-enabling platform, one that supports speed, confidence, and resilience in high-stakes planning environments.

No comment yet, add your voice below!